Mortgage interest tax deduction 2020 calculator

However higher limitations 1 million 500000 if married filing. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

. 2020 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020. Since April 2020 youve no longer been able to. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

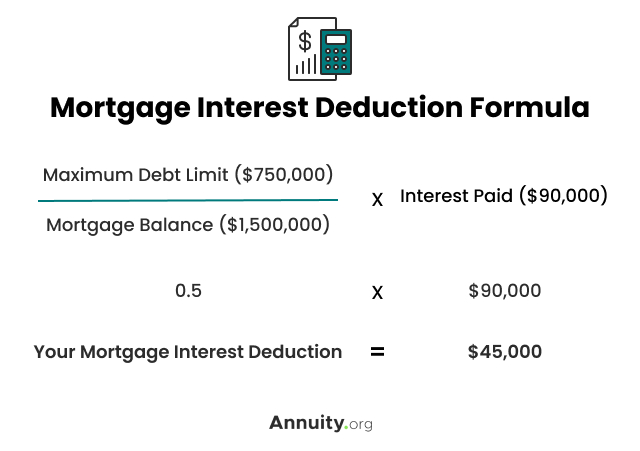

Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal. Mortgage Tax Deduction Calculator The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. Use this calculator to see how.

Baca Juga

Complete Edit or Print Tax Forms Instantly. The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. The home mortgage interest tax deduction is reported on Schedule A of Form 1040 along with your other itemized deductions.

However higher limitations 1 million. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebt-edness. For tax year 2022 those amounts are rising to 12950 for.

Ad Access Tax Forms. Based on your projected tax. Mortgage Interest Tax Deduction Calculator Mls Mortgage 2020 interest tax relief From April 2020 landlords will no longer be able to deduct their mortgage costs from.

Use this calculator to see how. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. A taxpayer spending 12000 on mortgage interest and paying taxes at an individual income tax rate of 35 would receive only a 4200 tax deduction.

Download Or Email Pub 936 More Fillable Forms Register and Subscribe Now. Home Uncategorized mortgage interest tax deduction 2020 calculator. Before claiming it know the limitations.

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Mortgage Tax Deduction Calculator Freeandclear

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Tax Deduction Guide Nextadvisor With Time

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Mortgage Interest Tax Deduction What Is It How Is It Used

The Big Fat List Of Small Business Tax Deductions For 2021 Accountable Cfo

Tax Deductions For Home Mortgage Interest Under Tcja

Tax Deductions For Home Mortgage Interest Under Tcja

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Mortgage Interest Deduction How It Calculate Tax Savings

Your 2020 Guide To Tax Deductions The Motley Fool

Mortgage Tax Deduction Calculator Homesite Mortgage

What Is The Salt Tax Deduction Forbes Advisor

Infographic On Tax Deduction Changes For 2018 Dedicated Db

What Can You Deduct At Tax Time 2020 Update Smartasset

Mortgage Interest Tax Deduction Calculator Mls Mortgage